Campus placements are a critical metric for evaluating the success and reputation of business schools worldwide. It is the primary influencer of their branding among the stakeholders, and more importantly, the aspiring students.

Over the last three years, the global job market has been undergoing rapid transformation, driven by economic factors, technological advancements, and evolving industry demands. The number of companies visiting business schools for placements as well as the number of offers made per company have come down. At the same time, the graduating students placement expectations have increased due to rising aspirations and career preferences. These factors make it all the more challenging for business schools to achieve placements that match the expectations of students.

However, a number of premier B-schools in India have realigned their placement strategies to expand the pipeline of recruiters. This article studies placement reports of nine premier business schools: top three IIMs, five private B-schools that appear in the top NIRF-2024 ranks under Management, and the Indian School of Business (ISB) to understand the placement trends. Besides analysing the placement trends, this article also dwells on the strategies and practices followed by B-schools to address the headwinds.

Need for strategic job market planning

Before the COVID-19 pandemic, due to buoyancy in demand for fresh MBA graduates, most of the leading B-schools could afford to limit their role to fulfill the growing demand from recruiters. Later, as the circumstances changed, it became imperative to understand the dynamics of the job market and the sectoral demand trends and align the strategies accordingly.

Churn in the recruiting companies

An analysis of the recruiters for the last three years reveals a significant churn in the existing recruiters year after year, forcing B-schools to add new ones. In the last three years, ISB added 230 first-time recruiters. It includes 70 new companies in 2024 who made 190 offers. ISB is not alone, as the percentage of new recruiters in the nine B-schools in 2024 ranges from as low as 18% to as high as 57%, leaving the retention rates of legacy recruiters at as low as 60%.

Drop-in “per company” offers

It may be noticed from Table 1 that the average number of placement offers made per company in three premier B-schools dropped by over 35% in the last three years. This drop impacts B-schools that look for bulk placement companies due to the large intake of students. Most of the premier B-schools provide multiple job offers to each student, to enable them to choose one.

Strategies to boost the pipeline of new recruiters

To address the placement challenges, the premier B-schools have been analysing the trend of recruitment, sector-wise, and identifying unexplored, yet potential sectors and sub-sectors for recruitment.

Also Read: Is an MBA still worth It? Evaluating ROI and future prospects in 2025

While most of them look for large corporates with an international or national presence, some have been leveraging the sectors, in the neighbourhood. Institutes like XLRI, Jamshedpur, and SIBM, Pune have focused on the automotive sector, SPJIMR, Mumbai, leverages the FMCG sector, whereas MDI, Gurgaon leverages telecom and media sectors.

They reach out to new target sectors and engage them by way of guest lectures, conclaves, seminars, management development programmes, and consulting projects. They also build close networks with industry leaders and alumni. Simultaneously, they target to increase the number of offers from the current recruiters, by deepening their relationships, thereby understanding the evolving new roles in the organisations so that they can align their programs accordingly.

To sharpen the focus on sectoral placements, IIM Ahmedabad has been following the Cluster-Cohort Placement System, wherein the organisations are grouped into cohorts based on their core business and industry profile, and groups of cohorts are invited to the campus across different clusters. The clusters are based on factors like industry type, job profiles, and company preferences. During the 2025 placement season, about 200 firms from multiple domains participated in 30 cohorts, across three clusters.

The Indian Institute of Management Kolkata also follows a similar placement system, wherein the cohorts are clustered based on student preferences, determined through a scoring system, where the students rate their interest in each cohort. This system was found to be beneficial for both the companies and the students, as it helps them find the right match for each other.

Major sectors for placement at the premier B-schools in 2024

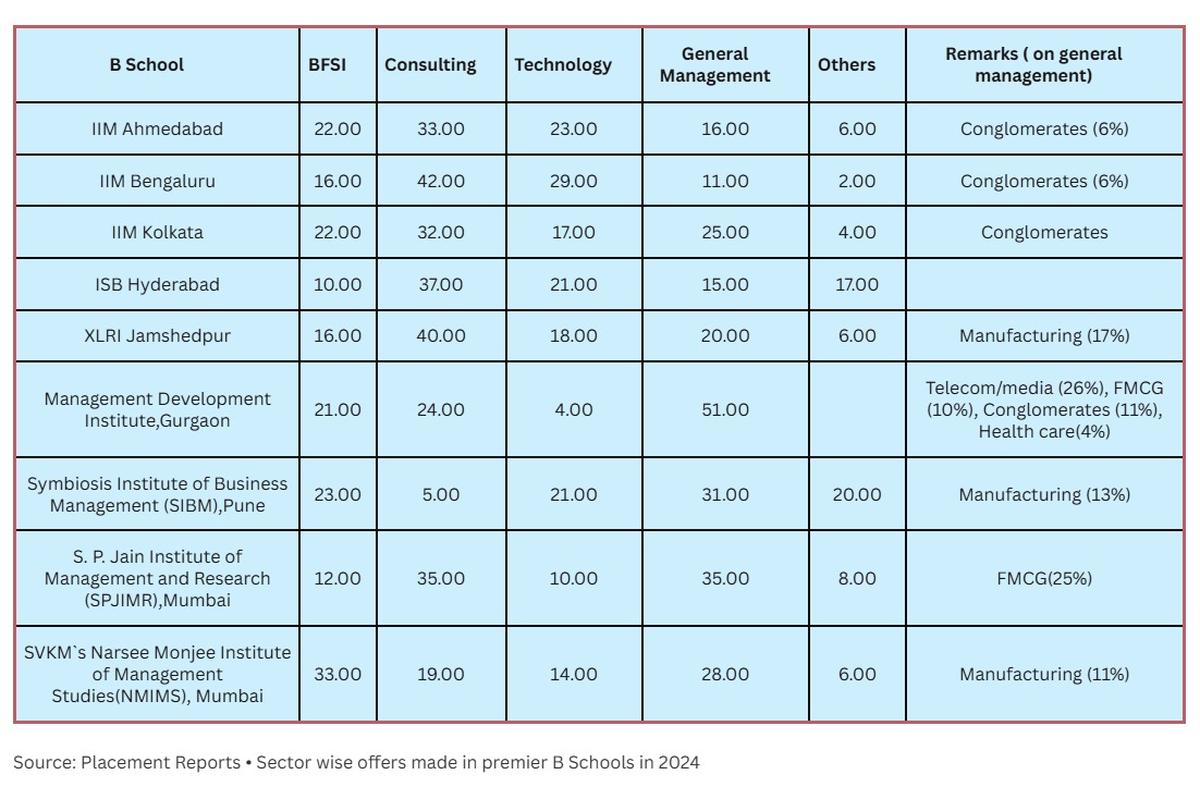

The contribution of the three major sectors: Consulting, Banking, Financial Services, and Insurance (BFSI), and Technology in nine premier B-schools in 2024 ranges from 49% to 87%. While consulting is the largest sector in the case of top-tier B-schools, it is the BFSI or FMCG sector that has been the largest contributor at the second-tier B-schools.

Sectoral trends over the last three years

Sectoral analysis over the last three years shows that the consulting sector continues to be strong in all five premier B-schools, i.e., IIMA, IIMB, IIMC, ISB, and XLRI. In 2023, the technology sector, which had gone overdrive in the previous year took a dip. The fall in technology placements had been compensated by sectors like healthcare, logistics, media, etc. In 2024, however, as technology got more entrenched into businesses, recovery started, driven by emerging sectors like Consumer Tech, FinTech, Global Competency Centres (GCCs), etc.

The BFSI sector has been steadily growing, driven by investment banking. The last three years have witnessed the emergence of new sectors like Green Energy, Electrical Vehicles, and Logistics. Conglomerates (Diversified Business Groups) have also started recruiting.

Consulting sector

Roles in the consulting sector are attractive to students, not only from the perspective of salary but also because of the intellectually stimulating job content and scope for career growth. McKinsey, Boston Consulting Group (BCG), and Bain and Company, called MBB, are considered to be top-notch management consultants globally, with Fortune 500 companies, as their clients. The Big-4 firms Deloitte, PwC, KPMG, and Ernst &Young, who started with accounting and audit services, also have their consulting arms and provide strategic advisory or consulting services in various functional areas, including IT.

A few years ago, most of the consulting placements used to be from the above seven consulting and professional services firms. However, in the last few years, most of the premier B-schools enlarged their reach in the consulting sector, by adding a number of next tier of advisory consulting firms, like Accenture, Arthur D Little, Kearney , LEK Consulting , Oliver Wyman, Vector Consulting, and more.

ISB reported that Accenture and Deloitte gave over 100 placement offers in 2024. IIMA highlighted a growth of 120% in placement offers from advisory consulting sector in 2025, though McKinsey and BCG continued to make good number of offers each in the top 3 IIMs in 2024 and 2025.

Technology sector

The year 2022 saw an unprecedented boom in the technology sector hiring, driven by IT services companies, who slowed down subsequently. Enterprise technology companies like Adobe, Google, Microsoft, FinIQ , Navi, and more stepped in and have been offering Product Management roles.

SPJIMR noted a 50% increase in product management offers during 2025, compared to the previous year. The last five years have witnessed huge growth in the number of Global Competency Centres (GCCs) to over 1,700 companies, working on cutting-edge technologies, employing over two million employees.

BFSI MNCs like Bank of New York, Barclays, Goldman Sachs have set up their GCCs in India, with a focus on data analytics and algorithmic trading, and have been offering challenging job roles to the MBAs. With more technology integration into businesses, the difference between sectors like retail and BFSI and technology thinning down led to buoyant hiring from Consumer Tech companies like Amazon, Flipkart, Purplle, and Zomato.

IIMA reported a steep growth of 800% in offers from Consumer Tech in 2025, while SPJIMR reported that 10% of the batch was hired by the e-commerce and quick commerce companies. Analytics firms are the recent ones to enter the Job market, contributing 5%-7% of the offers in the last two years. This trend will not only continue but is expected to accelerate, with time.

BFSI Sector

Commercial banks, which used to be a bulk recruiter from mid-tier B Schools two years back, have reduced hiring in 2025. However, the last three years have seen increased hiring by financial services sector, driven by investment banks, private equity, asset management, venture capital firms. They include not only large MNCs but also mid-sized firms like ARGA, Claypond, Arpwood, Elevation Capital, and more.

FMCG/Conglomerates

Large FMCG companies like Asian Paints, Hindustan Unilever, ITC Ltd, L’Oreal, Nestle, and pharma companies like Dabur, Glenmark and Sun Pharma have been continuing to recruit from the premier B-schools. Recent times have seen increasing recruitment from conglomerates (diversified business groups), like Aditya Birla group, Essar group, GMR group, Mahindra, RPG Group, Tata Administrative Services, Welspun, etc, to fuel their growth. XLRI reported a 10% share from conglomerates in 2023, whereas IIMA reported an increase of 135% offers from this cohort in 2024.

Emerging sectors

Sectors that have entered in the recent past include renewable energy, real estate, healthcare, electrical vehicles, logistics and media. With the rise of start-ups, roles in the ‘Founder’s office’ are offered in companies like OLA, Newme, ParkStreet, PoshN, and Kofluence etc.

Outlook for the future

With global uncertainty looming large, from geo-political-economical and technology perspectives, job markets are set to undergo major changes in the days to come. It is going to be more challenging for the Business Schools to cater to the demanding requirements of the recruiting companies and, at the same time, meet the expectations of the students.

In the earlier days, the campus placement season at the premier B schools used to end by January. In 2024, it got extended up to February. As for the current placement season for 2025, among the premier B schools, so far, only IIMA,IIMC ,IIM Lucknow and SPJIMR have publicly declared completion of placements. Next year, it is likely to be extended up to March or beyond.

With regard to the sectors, consulting will continue to reign supreme in premier B-schools , as good consultants are like doctors and are needed in good times as well as bad times. As emerging technologies like AI and data analytics get more entrenched into the business, technology will no longer be a business enabler, but the business itself.

As sustainability gets more integrated into the business and society, sectors like Electrical Vehicles and renewable energy will create more job opportunities. Start-ups also will recruit quality talent and pay market salaries.

The way forward

In order to address the placement challenges, the business schools have no other choice but to understand the dynamics of the job market and expand the pool of recruiters by reaching more sectors /sub-sectors by deploying time tested marketing strategies . It is also imperative to build a close partnership with all the recruiters and engage them on a continuous basis so as to understand and fulfill their evolving needs for quality manpower, which is the most valuable asset for survival and growth of organisations, in the days to come.

(Dr. O R S Rao is the chancellor of the ICFAI University, Sikkim. Views are personal.)

Published – March 10, 2025 03:46 pm IST